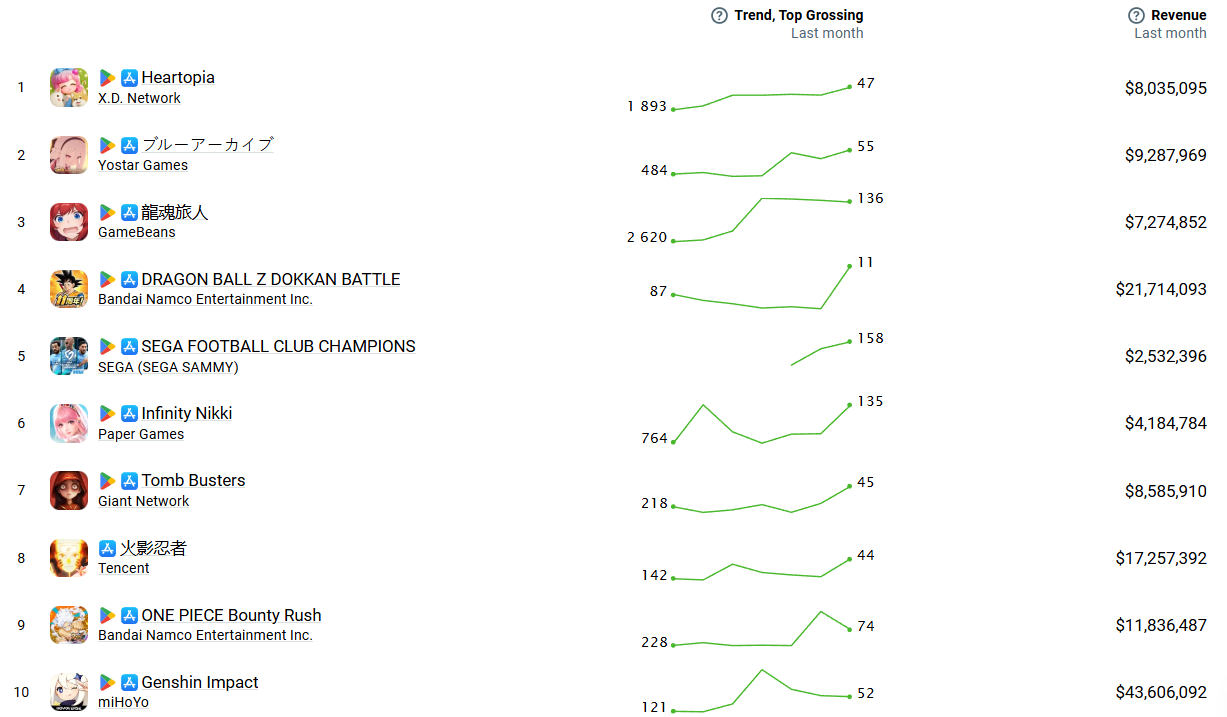

Top trending and grossing games of January

January split cleanly in two: cozy sims and casual builders drove massive installs, while gacha giants like Genshin Impact dominated revenue. Breakout life sim Heartopia proved new genres can scale fast - but old live-service hits still make the real money.

Top trending (free)

Notable mentions

Heartopia – I have to start with the obvious breakout. XD Network’s Heartopia exploded out of the gate after its early-January launch, pulling in roughly 10-12 million downloads in just weeks. Watching it climb to #1 on the App Store across dozens of countries, it’s clear players were ready for another cozy, social life sim. To me, this looks like the first real signal that life sims could become a defining casual trend this year.

Disney Solitaire – To see Disney Solitaire on the list comes as no surprise. SuperPlay blended TriPeaks solitaire with Disney and Pixar characters, and that familiarity clearly helped it scale fast after its late-2025 launch. Nearly 6 million January downloads is a serious volume for a card game. It also marks a strong early win for Playtika’s SuperPlay studio - polished gameplay plus globally recognised IP is still a powerful acquisition formula.

Block World 3D: Craft & Build – Sandbox crafting didn’t cool off after December. Block World 3D: Craft & Build led a cluster of Minecraft-style builders, adding about 4.7 million installs in January, with similar titles like Craft Explore and Block Craft 3D also charting. Whether this title retains players long term is still an open question, but right now the demand for open-ended voxel worlds is very real.

Antistress Relaxing Mini Games – Antistress Relaxing Mini Games from CAT Studio quietly reached roughly 2.8 million downloads in January. Collections of fidget-style and low-focus mini-games continue to perform because they’re easy to dip into and don’t demand commitment. From what I’m seeing, these apps function more like digital stress toys than traditional games - and that niche remains consistently large.

Bus Simulator: 3D Bus Games – Bus Simulator: 3D Bus Games by GamePark rolled to around 3.5 million installs in January without big branding or elaborate features. This seems like it is part of a broader pattern: accessible driving fantasies with simple progression loops continue to attract broad, global audiences, especially on Google Play.

Top grossing

Notable mentions

Genshin Impact – At about $43.6m in January, it earned more than the next several titles combined. What stands out to me is how HoYoverse continues to monetize through tightly scheduled character banners and limited-time events — a cadence that keeps high-value players spending month after month, even well past the game’s original launch window.

DRAGON BALL Z DOKKAN BATTLE – DRAGON BALL Z DOKKAN BATTLE pulling roughly $21.7M shows the enduring strength of legacy anime gacha. Bandai Namco’s strategy is very event-driven: nostalgia-fuelled character releases and anniversary-style campaigns consistently trigger spending spikes. I view this as a reminder that mature titles with deep content libraries can still rival newer games if their live ops calendar is disciplined.

火影忍者 (Naruto Mobile) – Tencent’s Naruto Mobile generated around $17.3m, which is significant for a regionally concentrated title. What I find notable is how well Tencent sustains monetization through competitive modes and frequent character updates tied to the long-running anime IP. It’s a case where strong domestic retention supports global-scale revenue without needing worldwide chart dominance.

ONE PIECE Bounty Rush – With about $11.8m in January revenue, ONE PIECE Bounty Rush reinforces how Bandai Namco leverages multiple anime IPs simultaneously. The studio’s approach is portfolio-based: staggered events across different franchises keep at least one title in a high-monetization phase at any given time. This shows the advantage of operating several live-service games under one licensed umbrella.

Heartopia – What’s most interesting about Heartopia isn’t just downloads - it’s that the game has already reached about $8m in January revenue so early in its lifecycle. That suggests effective early-game monetization, likely through cosmetic customisation and social-expression purchases rather than competitive spending.