Top Mobile Gaming Apps of June

June 2025 saw puzzle and arcade games led the world in new downloads, while strategy and classic casual games dominated spending. These rankings also highlight global trends – emerging markets like India fueling downloads, versus big spenders in China and the US driving revenue.

Below we break down why each category’s leaders rose to the top, with a look at standout regional influences and industry trends.

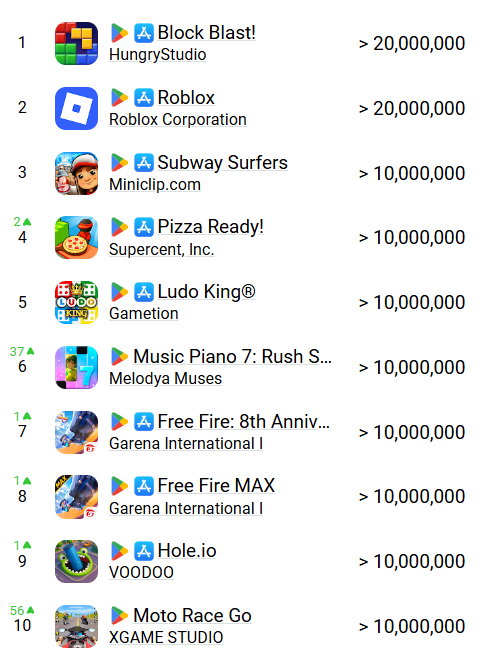

Top 10 Free Games

Based on highest downloads:

Casual puzzle appeal and familiar classics kept their grip on the download charts in June. Block Blast!, despite a ~25% dip in installs (from ~39–40 M to ~29 M), was the world’s most downloaded title, with over 29 million installs in the month. Close behind was the user-generated universe of Roblox (26.7 million downloads) and the ever-popular runner Subway Surfers (16.7 million). These perennial favourites leverage continuous updates and events to keep players coming – for example, Roblox’s branded in-game events (like a 15-day The Weeknd music experience) sustained its momentum across regions.

Familiar titles held strong due to regional loyalty. Pizza Ready!, May’s top title, stayed in the top five. Ludo King® maintained a high rank, driven by its massive audience in India, the world’s largest mobile game download market (8.4 billion annual downloads). Similarly, Subway Surfers stayed high on the charts thanks to continued popularity in India and Brazil.

Garena Free Fire and Free Fire MAX remained top downloads, boosted by their 8th-anniversary events and strong presence in Southeast Asia and Latin America. Older hyper-casual titles like Hole.io also reemerged, highlighting the lasting pull of simple, fast-paced gameplay.

Newcomers also broke through. Music Piano 7 debuted with 14.6 million downloads, while Moto Race Go entered the top ten with 12 million – both benefiting from aggressive social media ad campaigns.

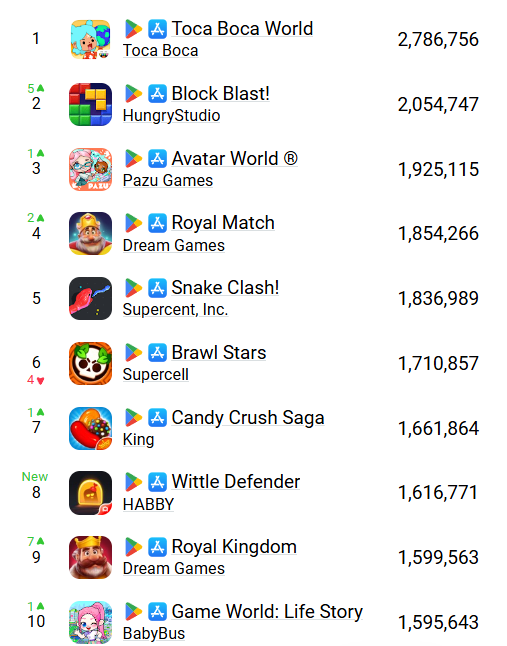

Top 10 Grossing Mobile Games

Based on highest revenue - estimated IAP revenue by platform fees and taxes:

Top grossing

In June 2025, Honor of Kings led global mobile game revenue with $143.3 million, largely from China. It was followed by 4X strategy titles Whiteout Survival ($127M) and Last War: Survival ($126.4M), which maintained strong earnings through alliance-based gameplay and timed PvP events. Casual hits Royal Match ($117M), MONOPOLY GO!, and Candy Crush Saga ($97M) also stayed in the top five, driven by event-based monetization and regular content updates. PUBG Mobile ranked seventh with $94M, while Pokémon GO surged back into the top ten at $62.6M after a successful update.

Rounding out the top ten were Pokémon TCG Pocket and Coin Master, each earning around $55–80M. Regional spending patterns showed China and the U.S. dominating revenue, while download-heavy markets like India and Southeast Asia contributed less financially. Globally, strategy, survival, and casino-style games led among core spenders, with puzzle and franchise games supported by casual players.

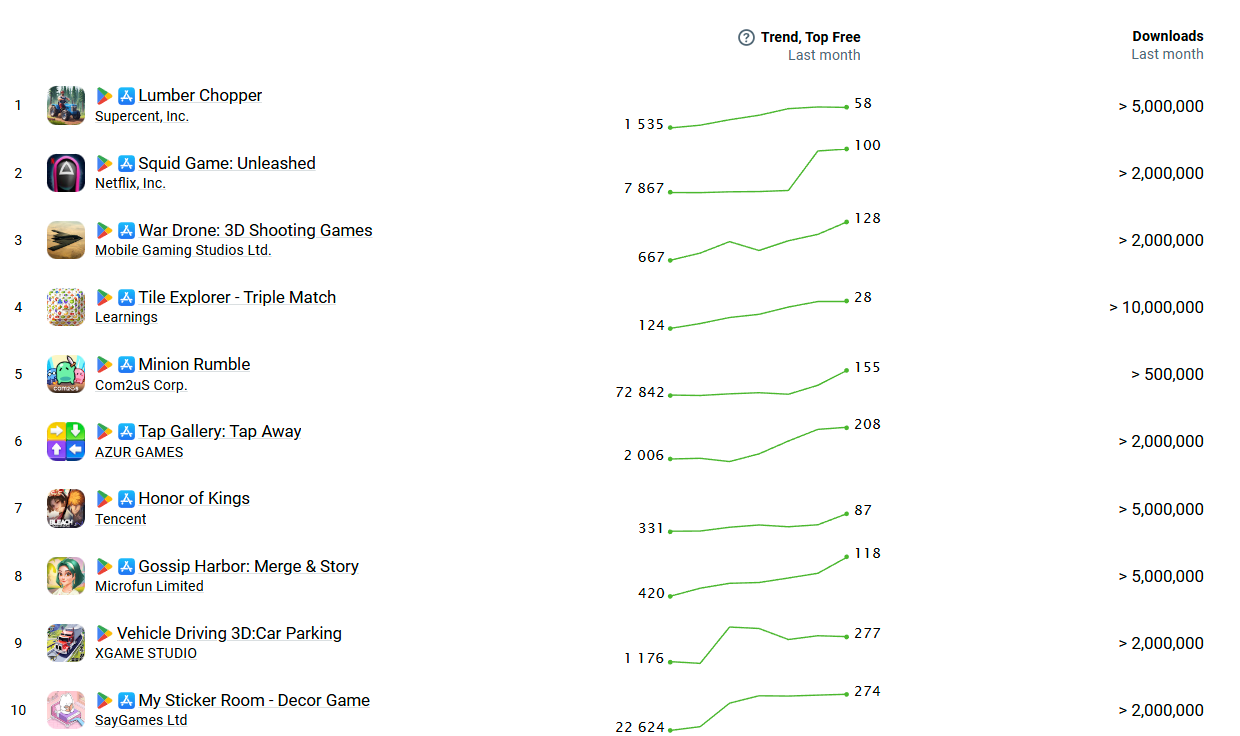

Top Trending Mobile Games - Gainers

Top Free

The green line shows the app's performance in the Top Charts over May - the left side indicates the starting position, and the right indicates its current position:

Tile Explorer – Triple Match outperformed (>10M downloads) through aggressive TikTok UGC campaigns that showcased “triple match fails,” tapping into meme culture for virality. Lumber Chopper scaled rapidly (>5M) by leaning into high-resolution ad creatives that mimicked simulation-style idle games, capturing simulator and ASMR audiences. Supercent also used interstitial-heavy UA across ad networks targeting low-CPI GEOs, with monetization likely skewed toward rewarded video.

Squid Game: Unleashed used Netflix’s hybrid UA funnel, deploying push notifications via its entertainment app and allowing gameplay without a subscription - effectively blending IP-driven acquisition with transmedia engagement. Meanwhile, Tap Gallery: Tap Away and Vehicle Driving 3D relied on mass-market appeal and low-friction mechanics to scale installs through cross-genre creative testing, especially in ad-monetized channels.

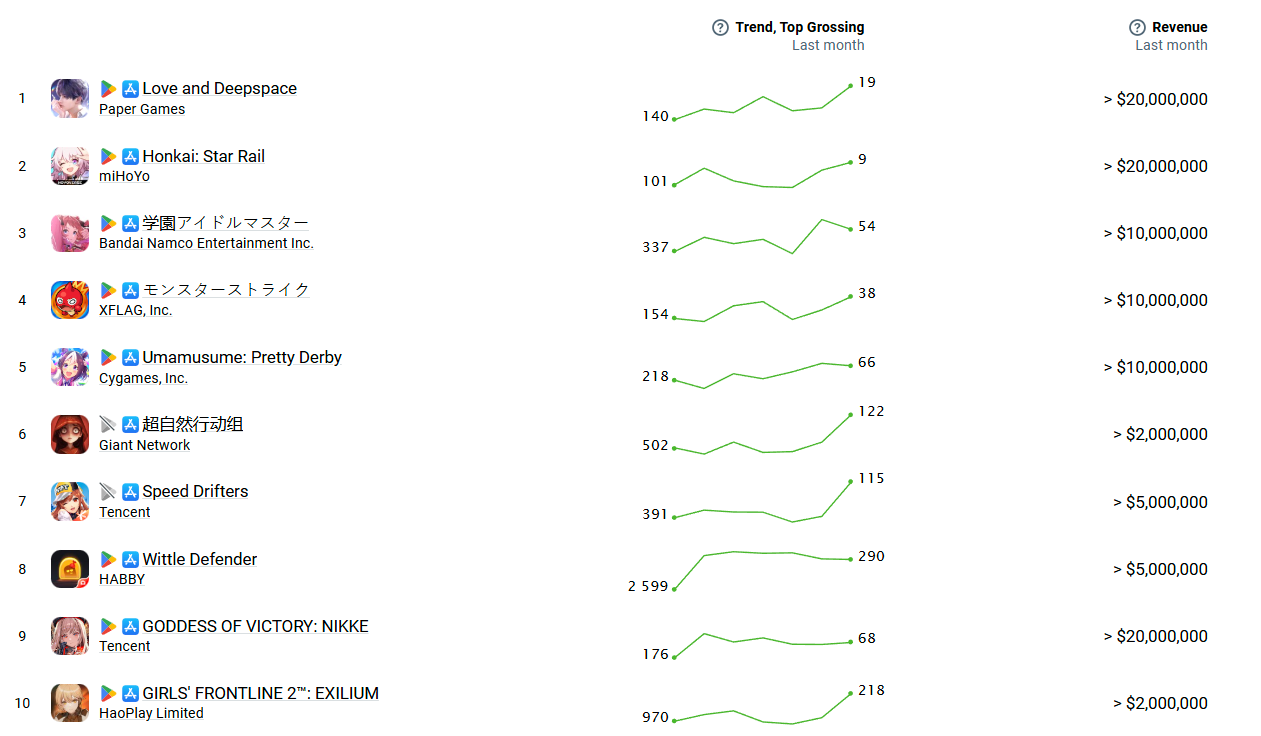

Top Grossing

Love and Deepspace exceeded $20M by blending otome dating sim mechanics with RPG-style monetization (gacha, costume IAPs), targeting a high-LTV female demo in China and SEA - markets often under-monetized in traditional RPGs. GODDESS OF VICTORY: NIKKE and Honkai: Star Rail maintained strong IAP by rotating limited banners and leveraging high production value; both integrated seasonal crossover events timed to audience spikes, although Honkai saw revenue dip post-peak due to content pacing issues.

Wittle Defender, despite modest downloads, achieved ARPU density via deep RPG mechanics grafted onto a tower defense core, supported by launch-timed whale offers and negligible ad monetization - targeting a core user base willing to spend early. Gossip Harbor, unusual in its hybrid strategy, now pulls ~$44M/month IAP, aided by flash sales, VIP systems, and progression gating - all built atop a merge-puzzle shell typically associated with ad-first monetization. Regionally, Japan’s Monster Strike and 学園アイドルマスター sustained earnings through tuned gacha mechanics and fanbase loyalty, while Girls’ Frontline 2 gained traction in China and Korea via pre-registration campaigns and franchise migration.