Top Trending Mobile Games of July

July 2025 saw some shifts, with blockbuster launches, regional breakouts, and anniversary events driving sharp gains. New titles like My Talking Tom Friends 2 surged to the top of global charts, while Ludo Naira found strong success in Nigeria. On the revenue side, anniversary events for Dragon Ball Z: Dokkan Battle and Blue Archive fuelled record spending, underscoring the impact of timed content and cross-platform expansion.

Top Trending Mobile Games - Gainers

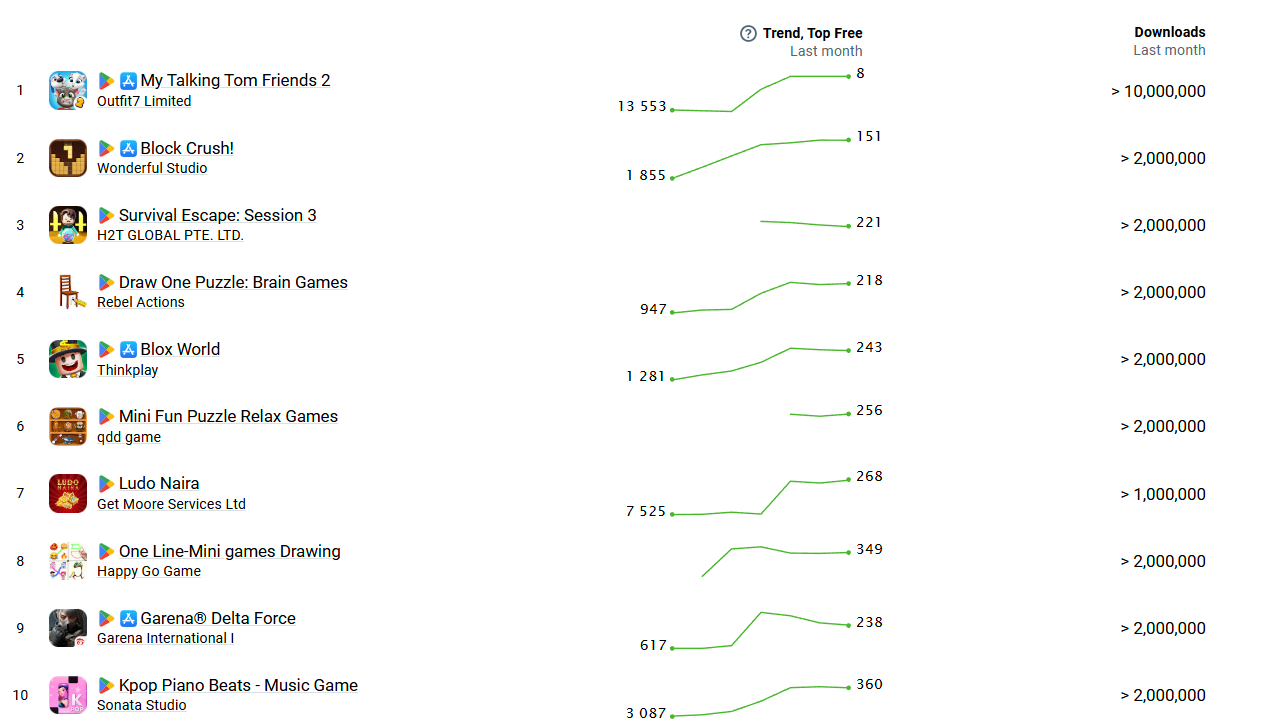

Top Free

The green line shows the app's performance in the Top Charts over May - the left side indicates the starting position, and the right indicates its current position:

Notable mentions

The (expected) star of July’s top trending games was My Talking Tom Friends 2 (Outfit7 Limited). The sequel to the popular virtual pet series launched globally on July 15, 2025 and quickly became the #1 free game in 31 countries. Within a week of launch it surpassed 10 million downloads. The developer Outfit7 achieved its highest-ever pre-registration conversion rate (>50% of pre-registrants downloaded) and saw strong engagement and retention post-launch. Engagement milestones reinforced the launch momentum: Outfit7's COO Jernej Česen stated that the early players demonstrated “strong engagement, high daily activity and retention”, adding: “The players who joined us didn’t just download the game -they stayed.”

Looking towards the global South, and an interesting view into regional successes, is Ludo Naira (Get Moore Services Ltd) - a mobile Ludo board game that’s especially popular in Nigeria. Launched in early 2025, Ludo Naira’s downloads have been climbing rapidly – it saw over half a million installs on Android in the last month, and likely more if including other sources), putting it beyond the 1 million mark overall. The developer, active since 2022, only has two apps (the other being Ludo Khazana, aimed at South Asia) and collectively has about 3 million downloads to date. The studio continues to capitalise on this momentum by frequently updating the app (several updates each month in 2025 to refine gameplay and add features). By focusing on an underserved audience and continuously improving the experience, Get Moore Services has secured a loyal user base and a strong hold on the digital board game segment in its target regions.

Another notable mention is Garena Delta Force (Garena International) is a new AAA first-person shooter revival of the classic Delta Force franchise. It officially launched globally in April 2025, bringing console-quality FPS action to mobile (built on Unreal Engine by a Tencent studio). In July, the game saw a significant boost thanks to a major crossover event with Arknights – its Season “Break” update introduced Arknights characters, exclusive skins, and limited-time missions.. This collaboration helped drive Delta Force’s downloads past 2 million for the month, as lapsed and new players jumped in to collect the special content. With its large-scale multiplayer combat and frequent content updates, Garena Delta Force is quickly becoming one of the hottest new shooters on mobile.

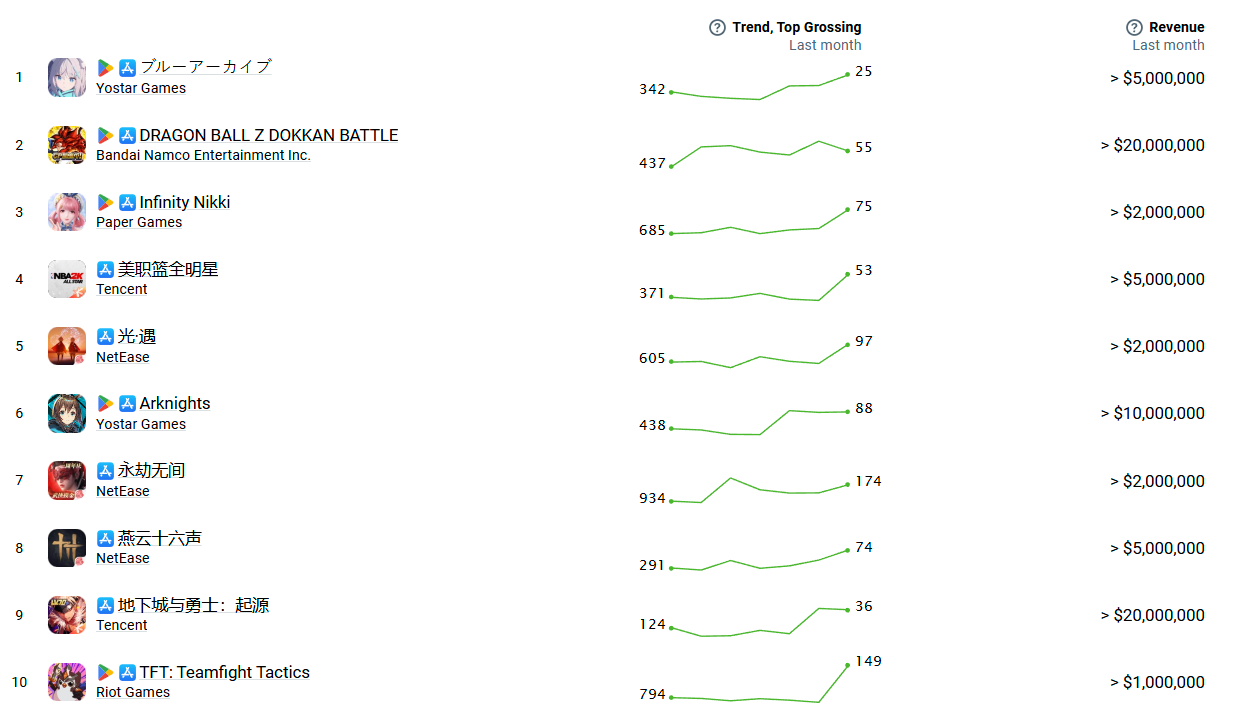

Top Grossing

Notable mentions

Blue Archive (~>$5M in July) – Yostar/Nexon’s anime RPG enjoyed a revenue spike thanks to a major anniversary event and expanded platforms. In late June, Blue Archive launched a PC (Steam) client and celebrated its anniversary, which bumped up sales noticeably. The combination of new story content, limited-time gacha banners, and cross-platform availability rekindled player excitement. Blue Archive climbed to the #1 trending grossing spot despite not having the highest absolute revenue, indicating a significant growth surge month-over-month.

Dragon Ball Z: Dokkan Battle (>~$20M) – Bandai Namco’s gacha RPG had a blockbuster anniversary in July. The game’s 8th Anniversary global celebration introduced sought-after characters in dual “Dokkan Festival” and “Legendary Summon Carnival” banners, prompting fans to splurge. On its peak day, Dokkan reportedly grossed over $3.1M in a single day when a new banner dropped. This longtime title shows how well-planned anniversary events (with generous rewards and hype) can reinvigorate spending even for a 10-year-old game. Dokkan’s unified global campaigns and fan-favourite releases translated into one of its best revenue months to date.

Looking to China, NBA 2K All-Star (美职篮全明星) (~>$5M) – A Tencent/2K co-developed basketball mobile game that has dominated China’s charts since launching in March 2025. Built on the console 2K engine with NBA official licensing, it delivers realistic 5v5 play and instantly attracted sports fans. It topped iOS download charts upon release and quickly became a leader in basketball mobile games. By July, ongoing events (e.g. playoffs content, new legendary players) and the game’s competitive season format sustained its high ARPU. This shows the power of AAA quality in sports: NBA All-Star is effectively the “NBA 2K for mobile,” and players are willing to spend on it similar to how they would on a console title (for packs, players, etc.).

Since its Chinese mobile launch in July 2024, 永劫无间 (Naraka: Bladepoint Mobile), is a juggernaut: it amassed 40+ million pre-registrations and topped the App Store free charts at launch. In its first month the mobile version’s revenue was estimated over ¥900 million (~$130 million) – one of the biggest mobile launches of 2024. While revenue has come down from those heights as the initial hype settled, Naraka Mobile still generated about $2 million last month. The game’s blend of martial-arts melee combat and battle royale gameplay fills a unique niche. NetEase reported that 70% of Naraka Mobile players were new (had not played the PC version), indicating it expanded the audience.

TFT: Teamfight Tactics – Riot Games’ auto-battler makes an appearance among the top grossers, earning around $1 million last month. TFT is available on both PC and mobile and is primarily known as a skill-based competitive game rather than a revenue monster. However, Riot has gradually expanded TFT’s monetization via cosmetics (Little Legend avatars, arenas) and a seasonal battle pass. In late July, TFT launched a highly-anticipated new Set (“K.O. Coliseum”, an anime-themed Set 15), which likely boosted player engagement and spending on the corresponding Pass and cosmetics. The fact TFT even registers on top grossing lists reflects the dedication of its player base – while most gameplay is free, a subset of players consistently purchase the optional cosmetics and passes to enhance their experience. Riot’s strategy of syncing mobile with PC updates has helped make TFT a cross-platform success, even if its monetization is more modest compared to typical mobile gachas.