Is Meta Back on iOS? The Data is Here!

Since the IDFA deprecation in spring 2021, Meta Audience Network’s performance on iOS has left a lot to be desired. Their share of total ad revenue typically stayed under 1%, with only "rare" instances reaching the 3%-5% range.

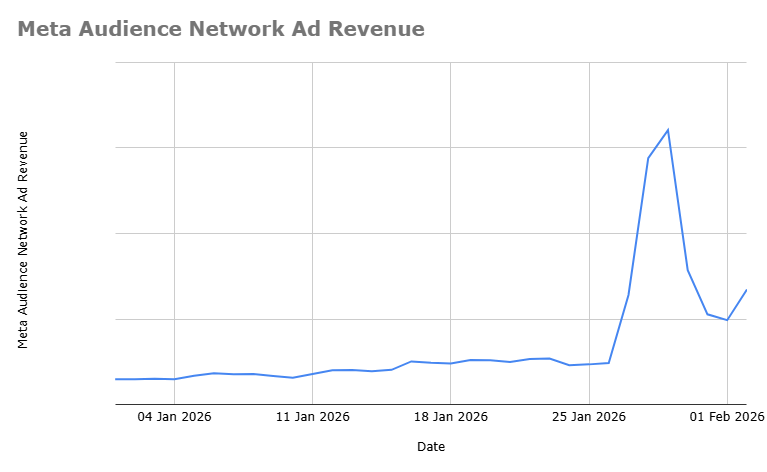

A couple of weeks ago, we were the first to report that Meta Audience Network's revenue is experiencing a significant surge. Now we have the data! Keep in mind this is still EXTREMELY early, and we will need several weeks to determine whether current figures will persist or settle at a stable level.

#1 What happened?

Meta Audience Network's revenue began climbing on January 27th, 2026, and increased multiple times over on January 28th and 29th.

This growth occurred exclusively on iOS and solely for rewarded video and interstitials. Banner ad performance remained unchanged. The analysis below focuses on this data specifically.

#2 How has Meta's performance shifted?

The data we gathered comes from 10 highly representative apps within the GameBiz Consulting portfolio (1 non-gaming app and 9 games spanning multiple genres). The table below compares the baseline period (January 1st - 26th, 2026) against the initial days following the shift for Meta Audience Network (January 28th - 29th, 2026).

- Total ad revenue share (increased by 3.5x to 15x, averaging 7.8x)

- Revenue ranking (advanced 3 to 9 positions, averaging 6.5 positions, reaching as high as #2)

- eCPM (growth ranging from +36.3% to +295.1%, averaging +125%)

#3 Has overall performance shifted?

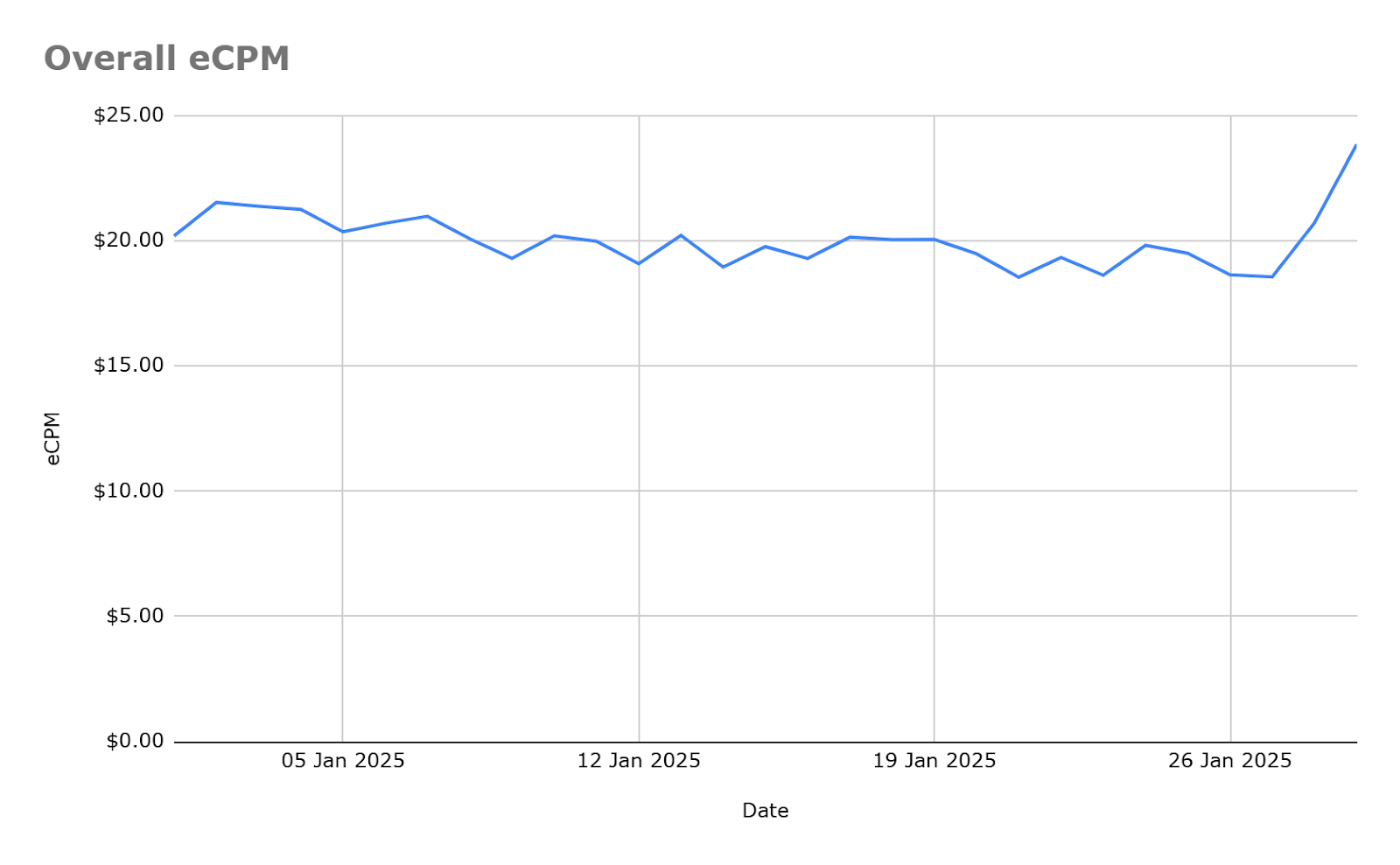

Unfortunately, not yet. Among the 10 apps examined in the previous section, only a single app experienced improved overall eCPM. This is App 5, which also recorded the largest eCPM increase (+295%), meaning it makes sense that this boost affects overall performance. The chart below displays the overall eCPM (all networks combined) for this app.

#4 How have other networks been impacted by Meta's surge?

Apart from the clear ranking shifts, revenue redistribution occurred across ad networks. Both UnityAds and Applovin have generated lower percentages of total revenue during Meta's growth period.

#5 Did Meta's surge originate from non-IDFA users?

Definitely not. Despite incorrect and factually false claims circulating online recently, non-IDFA users and impression opportunities are completely unrelated to the growth observed. To prove this, let's examine one example (we've confirmed this across dozens of games).

- Total Meta iOS revenue share before growth originating from Non-IDFA traffic was 4.51%. During the growth phase, that figure is nearly identical (4.45%).

- For this specific game, revenue from IDFA traffic was 16.8x higher (growth phase vs baseline). We observe nearly identical growth on non-IDFA traffic: 16.6x

- IDFA traffic contributed 95.6% of the additional revenue

- Simply examine the chart below - IDFA-traffic generates nearly all revenue

While Meta may be developing its non-IDFA revenue capabilities, we can definitely state that what we're currently witnessing is not that.

#6 Where has the growth actually originated from?

Initially, the growth source wasn't entirely clear. Meta announced in July 2025 they were reintroducing the Advanced Mobile Measurement program (Eric Seufert evaluates the impact in his article), and according to AdExchanger reports, they also upgraded Andromeda in December 2025.

While these modifications may contribute to Meta's iOS success, they aren't what's driving growth in this specific instance. Rather, it appears Meta has introduced new designs for iOS rewarded video and interstitial ads. These designs were reportedly already implemented on Android in 2025.

As of this writing, official details about these specific changes remain unavailable. We conclude this section by sharing here and here examples of how a couple of Meta ads currently appear. One displays a single ad from one advertiser, whereas the other features two advertisers presenting two creatives sequentially, within a single ad.

#7 What is Meta's statement?

There isn’t one yet. Meta declined to provide any comments at this time.

#8 How does performance data appear following this initial spike?

Following the initial surge, which was substantial, Meta's performance began declining. What we observe (currently) is that their performance hasn't returned to prior levels. Not even close.

Below is the revenue generated from Meta on iOS for rewarded video and interstitial ads across the same 10 apps analyzed above.

Comparing the prior period (January 1st - 26th, 2026) with the subsequent period (excluding initial days - so January 30th - February 02nd, 2026 represents the "new" after period), we observe sustained growth, though not as substantial as initially. More specifically, growth ranges from +38% to +460%, averaging +183%. See detailed breakdown per app below.

- App 1: 198.01%

- App 2: 91.01%

- App 3: 202.83%

- App 4: 217.99%

- App 5: 459.78%

- App 6: 172.32%

- App 7: 187.41%

- App 8: 88.23%

- App 9: 37.44%

- App 10: 163.19%

#9 What if you I’m not using Meta Audience Network on iOS?

We recommend integrating their SDK adapter and running an AB test to measure the ad ARPDAU improvement you can achieve by adding them. Important additional metrics include eCPM, revenue share and impression share from Meta, plus their influence on other ad networks. Remember that Meta continues to offer one of the most user-friendly ad templates available, so even without substantial additional revenue from adding them, the advantage of having more user-friendly ads should factor into your decision.

#10 In conclusion…

Meta substantially enhanced its iOS performance for rewarded video and interstitial ads. Banner performance shows no change.

During the initial days, revenue share growth ranged between x3.5 and x15, with eCPM averaging +125% growth

Post-initial boom, performance decreased but hasn't reverted to previous levels. Meta's revenue share currently sits +38% to +460% higher across GameBiz Consulting clients' portfolio.

If Meta isn't currently in your setup, you should absolutely test it.

This article was originally published as part of the GameBiz Consulting Ad Monetization Newsletter series. You can read it here.