Top trending mobile games of November

November’s trending download charts were a reminder of how unpredictable mobile momentum can be. From AAA console ports crashing into the mainstream to indie oddities blowing up on social feeds, the month delivered hits from every corner of the market. What stood out most was how different each success story looked - and how sharply audience behaviour shifted when the right content dropped at the right moment.

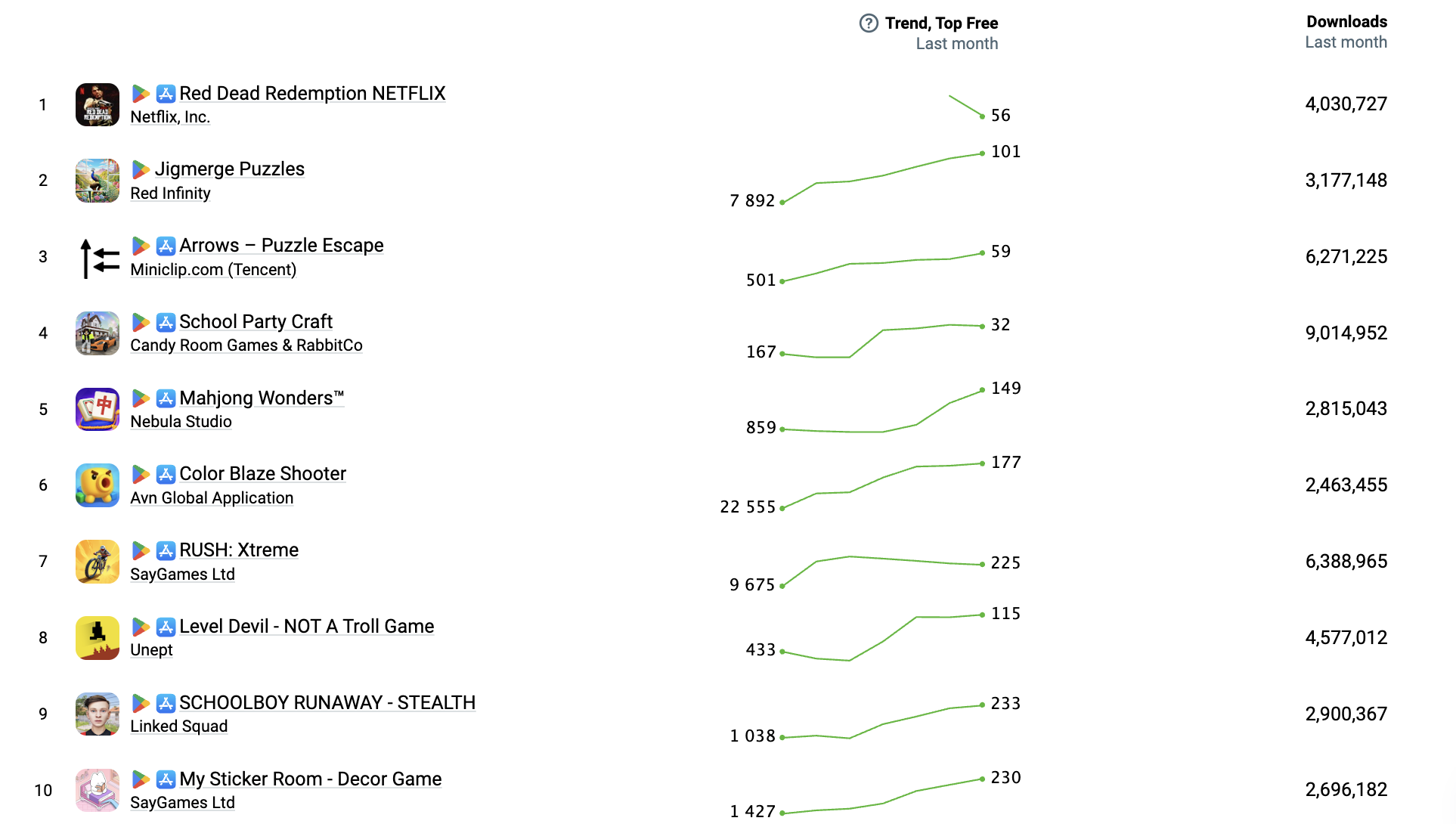

Top trending (free games)

Notable mentions

Red Dead Redemption (Netflix) – Netflix tapped one of gaming’s most iconic franchises for its growing games platform, and it paid off. The mobile port of Rockstar’s epic gained 4.03 million downloads as subscribers jumped at the chance to play a AAA open-world classic on the go. The Netflix edition shot to #1 on iOS app charts across multiple countries at launch, leveraging Rockstar’s legendary IP and Netflix’s 300+ million subscriber base to bring console-quality adventure to mobile.

School Party Craft (Candy Room Games & RabbitCo) – This blocky life-sim sandbox for teens played to its strengths and amassed 9.01 million global downloads in November. A cubic open-world simulator reminiscent of Roblox/Minecraft, it lets players socialise, build homes, and explore a vibrant city. Regular content updates (like a new Season Zero launch) and broad appeal among young audiences kept School Party Craft riding high in the charts.

RUSH: Xtreme (SayGames) – SayGames extended its hyper-casual dominance into racing, and the audience responded. The dirt-bike racer went to 6.39 million downloads worldwide behind adrenaline-fuelled, bite-sized races and an aggressive ad campaign. In its first month, RUSH: Xtreme quickly climbed to #1 in Google Play’s free racing category, as widespread ads drew in players.

Arrows – Puzzle Escape (Miniclip) – Miniclip’s foray into casual puzzles paid off with Arrows, a minimalist brainteaser that challenges players’ logic and spatial thinking. The game quietly pulled in 6.27 million downloads in November as players got hooked on its simple “extract the arrows” mechanic and no-pressure gameplay. Backed by user acquisition from Miniclip and thousands of levels, Arrows – Puzzle Escape turned a clever concept into a mass-market hit.

Level Devil – NOT A Troll Game (Unept) – This 2D platformer became an indie sensation through sheer novelty. Level Devil piled up 4.58 million downloads in November thanks to its fiendishly clever trap-filled levels hidden behind a cute facade. With players sharing clips of its unexpected obstacles on TikTok and other socials, the game’s clever “not a troll” branding turned viral. Lacking a big publisher, Level Devil relied on organic buzz and the enduring appeal of its frustrating-yet-fun gameplay to climb the charts.

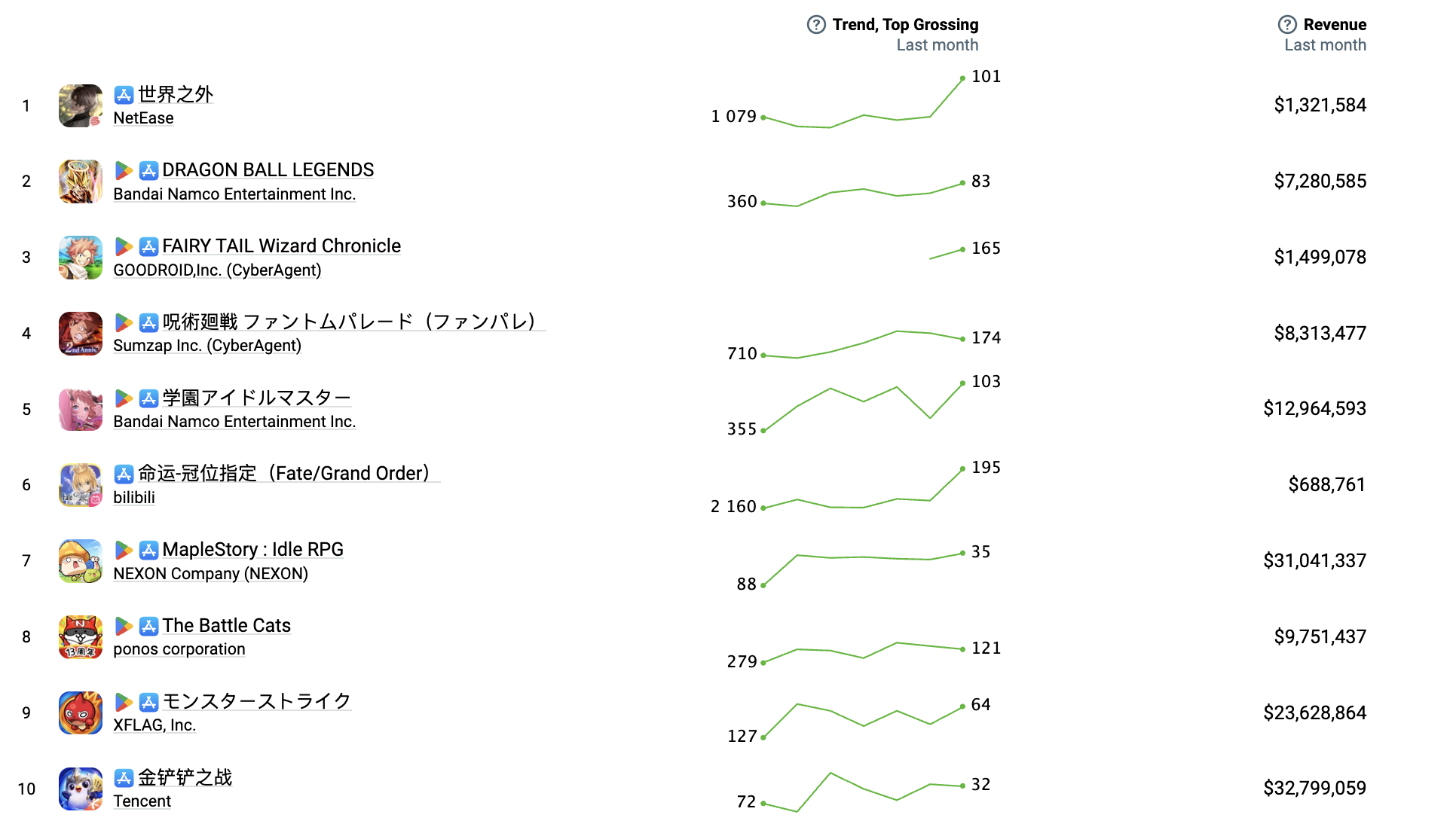

Top grossing

Notable mentions

MapleStory: Idle RPG is particularly notable with around $31 million in November, which is remarkable given its global launch only in early November. That’s essentially its first full month of revenue, surging from virtually nothing in October. One big driver was the MapleStory IP’s nostalgia factor – this idle spin-off tapped into a loyal fanbase in markets like Korea, Taiwan, and even the U.S. It’s interesting to note how an “idle RPG” managed to crack the top charts; Nexon’s pre-launch hype (and generous pre-registration rewards) clearly paid off, making MapleStory Idle the #2 top-gaining title globally in November.

Teamfight Tactics’ mobile edition in China (“金铲铲之战”) stood out with roughly $32.8 million in November. That’s a hefty ~38% jump over its October earnings. One big driver was a late-November limited-time event – essentially a special “returning season” mode with themed rewards – that spiked spending by players. It’s interesting to note that this auto-battler is two years old but still booming; the Nov 20–30 event alone drove over $18 million in revenue in just ten days.. In fact, the surge even pushed TFT past PUBG Mobile’s Chinese edition to become the #2 iOS game in China that month. This shows how fresh content and clever event timing can re-energize a mature title’s monetization.

Gakuen Idolmaster pulled in nearly $13 million in November, about 50% higher than its October take. This title stood out because a single content update – the introduction of a new idol character gacha on November 16 – catapulted it from rank #52 to #1 on Japan’s App Store literally overnight. One big driver was that limited banner featuring a fan-favorite new idol; Idolmaster fans responded by opening their wallets, boosting monthly revenue well above the prior month. It’s interesting to note the franchise’s power here: Bandai Namco strategically dropped coveted content mid-month, and the ensuing spike underscores how a loyal fanbase will spend big when presented with fresh characters and story content at the right moment.

Jujutsu Kaisen: Phantom Parade saw a huge comeback in November with about $8.3 million – almost 4× its October revenue. This title stood out because it skyrocketed roughly 40 places up the revenue rankings, a surge fuelled by major year-end events. One big driver was its first-anniversary celebration (the game launched around this time last year) combined with limited-time content that tapped into the popular anime’s fanbase. It’s interesting to note that even a year after launch, the right event can jolt a game’s earnings – beloved Jujutsu Kaisen characters and holiday rewards brought lapsed players back and had them spending liberally. The IP’s strength is clearly on display, as Phantom Parade’s strategic celebratory campaign nearly quadrupled its monthly revenue.

Monster Strike pulled in about $23.6 million in November. While that’s a bit lower than its October haul, this decade old game still had a standout monetization moment: a crossover with the Yu-Gi-Oh! anime series launched on November 15. One big driver was this mid-month collab event – it immediately vaulted Monster Strike from 11th to 3rd on Japan’s sales charts as fans rushed to snag limited-time Yu-Gi-Oh characters. It’s interesting to note that even after 10+ years, Monster Strike can surge back up the rankings with the right IP partnership. XFLAG’s strategy of pairing beloved external franchises with its gacha mechanics continues to pay off, sustaining Monster Strike’s top-tier revenue and keeping its veteran player base engaged through special events.